Origin Stories

Our thoughts on finance, technology, entrepreneurship, capital markets, and more.

A look back on 2022 at Origin

I don’t often talk about us on the blog, but I thought I’d share a few of the highlights that we celebrated. Find some of our major wins here:

What Canary Wharf did next…

This week we had the privilege of catching up with friends and clients at our annual drinks event in Paris. It got us thinking about the nature of the modern financial hub and how the status of different cities has evolved in recent years.

What ChatGPT thinks about the future of capital markets

We asked AI what it thinks about the future of capital markets. Here are the results.

Bitcoin’s last gasp?

This week, the ECB has been vocal in sharing its prognosis for the future of bitcoin. It claims that the crypto-asset has embarked on a road to irrelevance. I think this is incredibly naive.

When do central bank losses matter?

This week, Treasury bailed out the BoE for first losses on QE. It’s crucial to understand whether these “losses” should be a cause for concern.

Liquidity in the Bond Market

Liquidity in the bond market has been a challenge for well over a decade now. Recent events show that despite the macro environment changing, these liquidity problems show no sign of abating.

Crypto’s Icarus moment

A wild week on crypto. Over the past few days, events took an ultra chaotic turn when a run on FTX created a fire sale that could burn down the entire ecosystem. What caused the chaos? Is it an isolated incident or an existential threat? And what might the future hold?

Should the UK issue perpetual bonds?

George Soros recently suggested that the UK should issue perpetual bonds. It’s an interesting concept that should be taken seriously.

The Banker PM

Another month, another prime minister. What does Rishi mean for the UK? Can he calm the fomenting markets? How long will he last?

Cash is King

For the longest time, we have been in a ZIRP environment, and cash was an afterthought. That is changing rapidly.

Uppers and Downers

This week, the Bank of England was forced to stabilise the UK Gilt market… again. The reason being, much to PM Truss’ dismay, economic chaos continues to reign.

What Elon Musk's messages tell us

The Twitter v. Musk saga continues to rage on. The inner workings of Silicon Valley’s VC, with billions committed through text messages, explained.

The wildest of rides

Keeping up to date with UK economics and politics over the past few months has felt a bit like riding a rollercoaster. And the scariest part is that we have no idea when the thrills and spills are going to end.

Time to prove Ethereum’s worth

Aside from the neverending whipsaw market volatility, something big went down in crypto yesterday - Ethereum completed its long awaited Merge.

A question of energy and balance

Energy has been in the headlines the past week for good reason. In the UK, last week we found out about the energy price cap rising over 80%, with predictions of a further doubling likely.

Tiger King

Julian Robertson, who recently passed away at the grand old age of 90, was a heavyweight of the hedge fund industry.

An Interview With…Charles Douglas

In the latest instalment of our interview series, I chatted with Charles Douglas, who joined Origin in July 2021 as a Business Development Analyst.

An Interview With…Harry Cooper

In the latest instalment of our interview series, I chatted with Harry Cooper, who joined Origin in July 2021 as a Graduate Software Engineer.

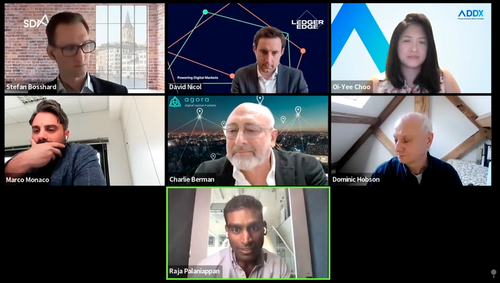

The great blockchain debate

“Blockchain in the bond markets could be a Trojan virus that kills incumbents.” That was the title of a panel I attended this week. It was a lively discussion that brought together bankers, issuers, investors, digital asset players, and technologists to share perspectives on blockchain and its implications for capital markets.

An Interview With…Anusha Sonthalia

In the latest instalment of our interview series, I chatted with Anusha Sonthalia, who joined Origin in July 2021 as a Junior Product Manager.

Receive content like this directly to your inbox.

Subscribe to our mailing list. We will never share your details.