Origin Stories

Our thoughts on finance, technology, entrepreneurship, capital markets, and more.

Beyond Documents: Unlocking the Power of Structured Data with Origin Integrations

When most people think of Origin, they think of documentation. And that makes sense - over the past 5 years, our Documentation product has become the industry standard for automating bond issuance documentation.

But documentation is only half the story. The real value comes from what sits underneath: structured data. And the biggest opportunity lies in how that data can flow - cleanly, consistently, and automatically - into the systems that power our clients’ businesses and the wider market infrastructure.

The most interesting financial markets of our time

We are navigating through historical markets. How should issuers respond and react to such volatility?

How AI will transform capital markets

Here we are in the first working week of 2025, and AI is everywhere. But, haven’t we been here before? We’ve seen plenty of technologies get massively hyped up that failed to live up to expectations (eg IoT, 3D printing, Web3, the Metaverse, etc). Shouldn’t we be a bit circumspect about all this AI bullishness? How about specifically in the context of our industry - international capital markets. How much will AI truly change the way we do business?

How we built Origin Intelligence

Origin Intelligence combines the latest LLM technology with Origin’s proprietary data layer to extract up to 79 structured data points from bond termsheets and final terms. Our Lead Product Manager John Judeh explains why Origin Intelligence was built, what’s under the hood, and how it performs.

The global move to shorter settlement periods

It might be hard to imagine now, but back in the ancient history of securities trading (ie the 1970s and 1980s), UK equities trades used to settle on a 2 week cycle. The advent of fax machines and telex machines helped bring that down to T+10, then T+5, then T+3, and then eventually T+2. The US markets have been on their own journey, moving from T+5 to T+3 in 1995, and then to T+2 in 2017.

Earlier this year in May, the US took the leap down to T+1.

A new record!

Origin has hit an exciting new milestone, breaking another record in our Documentation product. We’ve now processed 140 transactions year to date via Origin Documentation, breaking last year’s record of 138… and we still have over 3 months left to go in the year.

Our approach to information security

It’s been a pretty eventful few weeks in the world of information security. Crowdstrike managed to single handedly take down a meaningful portion of the world’s computer systems. Followed by Microsoft facing further issues on Tuesday. Given the above, I thought I’d share some of our information security journey. Ever since starting Origin we've always been incredibly paranoid when it comes to information and cyber security.

A Busy Year

We’re also proud to share that for the fourth year in a row, Origin has picked up the awards for “Best Technology Platform for the Primary Bond Markets.” In previous years the awards were granted just for the SSA and FIG markets, but this year for the first time Global Capital gave an award for the Corporate market as well. Excitingly for us it was a hat-trick this year, with Origin picking up the accolades across all three categories!

The promise of faster settlement

This week on the blog, Raja delves into the upcoming shift from T+2 to T+1 settlement in US equity trades and it’s various implications. In general, faster settlements can mitigate risks, while prompting anticipation of regulatory changes in Europe. In the meantime, Origin's product offering and solutions, are already poised to streamline processes and be an enabler for faster settlements. Despite market participants’ usual resistance to change, regulatory push will ultimately foster adaptation, and hopefully paving the way for new opportunities in the debt capital market as well. And we at Origin will look forward to helping our clients make the most of those opportunities.

The US calls time on TikTok

In a pivotal move, the US House of Representatives voted to ban TikTok, signalling deep-seated concerns over data privacy and national security. Project Texas, TikTok's collaboration with Oracle, hasn't been able to assuage fears, and the proposed ban gives ByteDance six months to sell TikTok to a non-Chinese entity. This week on the blog, Raja reflects on the delicate balance between national security and global connectivity, in the face of a cautionary shift in the tech sector's trajectory. The repercussions could be profound for not only content creators and businesses, but also have large implications on the worrying trend of de-globalisation in recent years.

The tricky task facing global DMOs

There was an interesting piece in the FT this week about how a group of cross-party MPs in the UK have encouraged the Treasury to do more to ensure that government debt is issued at the lowest possible cost to taxpayers.

Sounds sensible, but sensible is often far from simple, especially as this will likely be a record year for gilt sales and a general election is looming on the horizon. The caution also neatly illustrates the challenges facing many debt management offices the world over in 2024.

A long-term fix to an age-old mortgage problem

For someone familiar with both the UK and US housing markets, Perenna's long-term fixed-rate mortgage approach has probably captured their attention. Unlike the UK's short-term focus, Perenna offers stability reminiscent of the US's 30-year fixed-rate tradition. This week, Raja looks into Perenna’s approach to possibly reshape the UK mortgage scene, providing much-needed options, especially for first-time buyers. However, challenges in funding strategies and regulatory landscapes persist. Nonetheless, Perenna's vision ignites hope for a more accessible and equitable housing market in the UK.

An uber-sensible approach

Coming into 2024, we appear to be seeing a shift in focus for the tech giants of the world. This week on the blog, Raja explores a shift towards a more grounded approach in the tech and financial sectors, epitomised by Uber's unexpected annual operating profit. This marks a departure from its previous strategy of relentless growth at any cost, signalling a return to traditional methods. The trend extends beyond tech, with Barclays unveiling a strategy focused on profitability and returning cash to investors. While the importance of innovation can never be understated, companies are opting for a more balanced approach over the hype-driven ethos of the past decade.

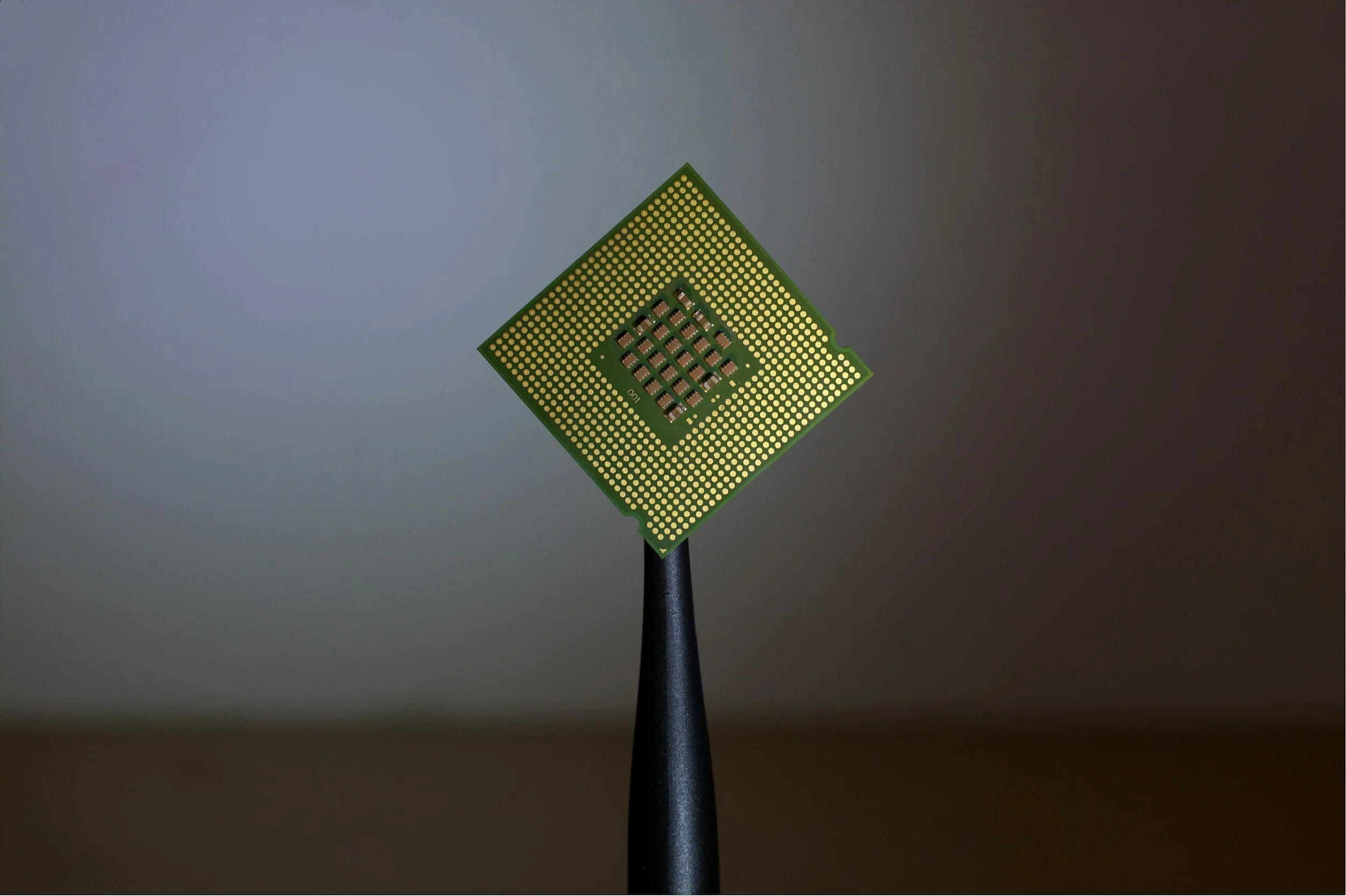

Hot chips

As microchip stocks soar, propelled by stalwarts like Intel and rising stars like Nvidia, the global equity market buzzes with anticipation. This week on the blog, we dive into industry leaders such as Arm's IPO success and Nvidia's evolution, which exemplify the industry's trajectory, underpinned by AI demand. Despite bubble fears, the ongoing AI revolution suggests continued upside potential for chip companies, positioning them as crucial players in shaping future technology landscapes.

Facebook at 20

This week, Raja is back in the US travelling to a wedding in San Francisco and an MIT reunion in Boston. Coincidentally, Facebook celebrated its 20th anniversary this week. Upon reflection, the social networking giant has played a big role in maintaining connections with his college friends. Despite declining personal usage, Meta's recent success and innovations, including strategic acquisitions, keep investors optimistic. While social media platforms may not look like what they used to be, their robust performance will leave us pondering Facebook’s fortune in another 20 years.

Back to the old school in alternative assets

In the past year, we saw the alternative assets landscape facing significant slowdowns after a more than decade-long bull run. This week on the blog, we take a look at 2024 prospects for a range of alternative assets. VC is reeling from a 2023 funding collapse, particularly in the tech sector, while PE is patiently sitting on $4 trillion of dry powder. M&A activities show flickers of optimism, but uncertainty still looms. Across the board, it seems that a return to traditional deal-making amidst market volatility and economic unpredictability will be the order of the day.

Endorsed but entirely unpredictable

The SEC's recent approval of 11 spot Bitcoin ETFs marked a significant shift from the previous rejection a year ago. Despite optimism, caution is advised, with SEC Chair Gary Gensler clarifying that the approval doesn't endorse BTC itself. This week on the blog, Raja discusses BTC’s long-term value, which remains largely speculative in our view, as well as offering some (admittedly less than useful) investment advice.

The problem of design for incumbents

This week, Boeing is in crisis mode (again) after an incident with Alaska Airlines. The aging Boeing 737, facing competition from the more efficient Airbus A320, introduced incremental changes with the 737-Max, leading to crashes in 2018 and 2019. This highlights the risks of incremental design tweaks and the pressure to maintain market share. In contrast, Zoom disrupted the video conferencing industry with an agile approach. While building software and planes are inherently different, Zoom may well be an approach that Boeing could learn from.

A Historic Year for Global Politics

Over 50 countries in the world are set to conduct elections in 2024, which means we’re inevitably in for a political tidal wave. With more than half of the world’s population going to poll stations, the results of elections will surely have huge implications for domestic policies, international relations, and economics. This week on the blog, we look at some of the most significant elections taking place in 2024.

Lessons we’ve learned whilst digitalising DCM

This week, we published a whitepaper that summarises the lessons we’ve learned from digitalising more than 90 debt issuance programmes.

Receive content like this directly to your inbox.

Subscribe to our mailing list. We will never share your details.