Origin Stories

Our thoughts on finance, technology, entrepreneurship, capital markets, and more.

Our Truths of Hiring

Origin’s recruitment and hiring process has been a huge contributor to our success. This week, Robert goes behind the scenes to explain what Origin looks for from junior talents, and how we foster their growth into business leaders.

The Complexity of Simplicity

This week on the blog, our Co-Founder and CTO Robert Taylor shares his thoughts on the client onboarding process for the Origin Documentation product.

The lesser of two incompetencies

This week, Rishi Sunak dropped a bombshell by announcing the cancellation of the northern section of the HS2 high speed rail project in the UK. For those in the UK, this looks like an internationally outlandish and foolish decision. But look across the pond, and the parallels with another high profile high speed rail project in California are eerily similar. This week, we look at the various economic and political implications these troubles may represent for their respective home countries, and how this all relates to one of our favourite cognitive biases: the sunk cost fallacy.

The wrongs of regulation

This week, Raja came across a talk by legendary investor Bill Gurley, who spoke about regulatory capture. Raja shares his thoughts on the subject and how today’s tech sector in particular, should be aware of the many dangers of misguided regulation.

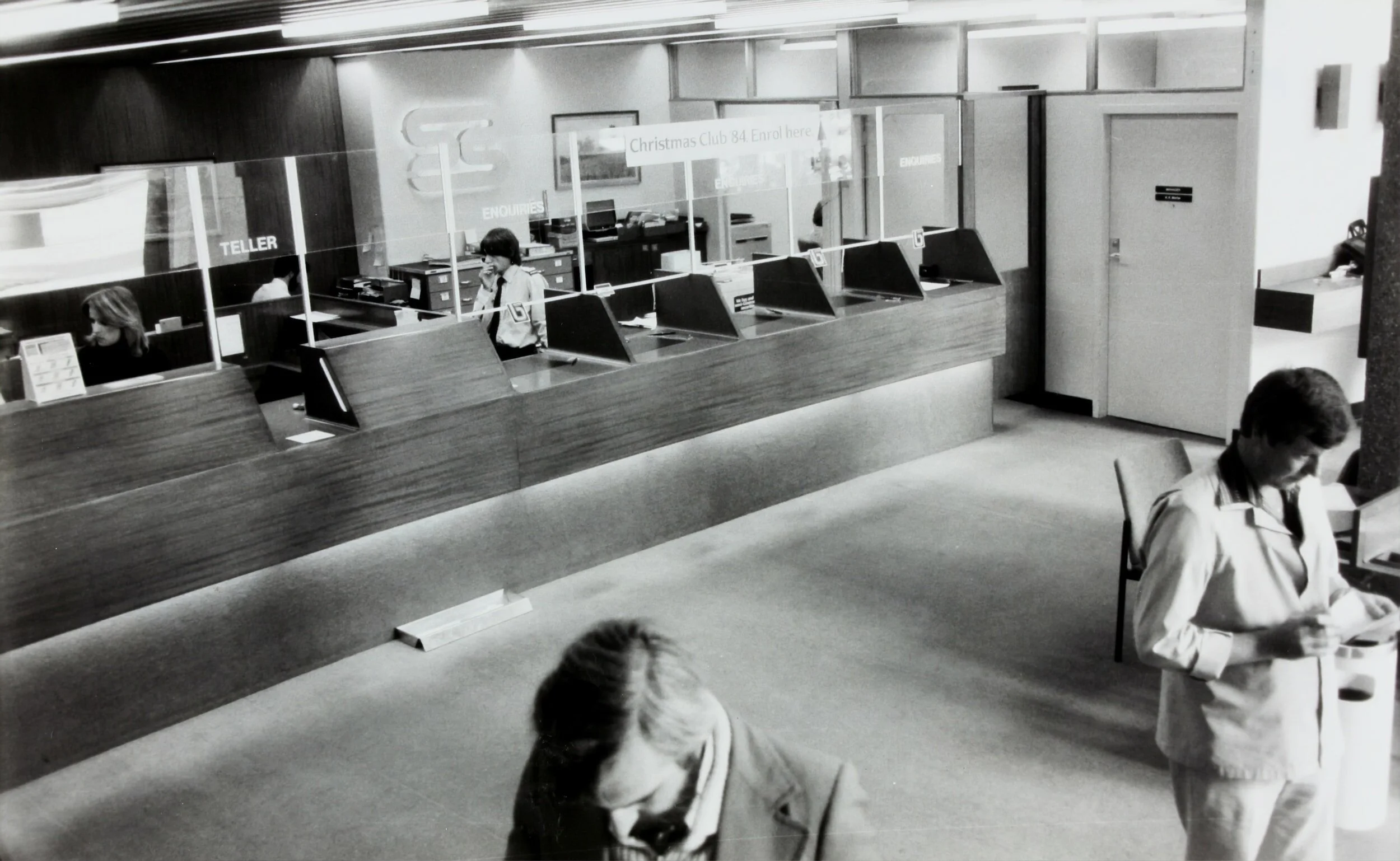

A paradigm shift in the UK mortgage market?

Perenna has gotten regulatory approval and is set to start offering 30-year fixed rate mortgages in the UK, where frequent refinancing is much more prevalent. Raja shares his thoughts on what this might mean for the housing market, and how Origin can help transforming the market for the better.

A test of Arm’s strength

Arm is targeting for an ambitious $48-52bn valuation in its upcoming IPO - possibly the biggest of the year. Despite questions regarding its valuation, fellow tech giants like Apple and Nvidia are lining up to back that price tag.

Living on the Edge: What Fintech Can Learn from Flight Cancellations

Our flight home on Monday was canceled due to the air traffic control malfunction in the UK. We made the best of it with an impromptu city break, and I can certainly think of worse places than The Tiger City to be stranded for a few days.

A very Nordic attitude towards sustainability

This week, I have been traveling in the Nordics, returning to one of my favourite parts of the world to meet clients and friends in Sweden and Norway.

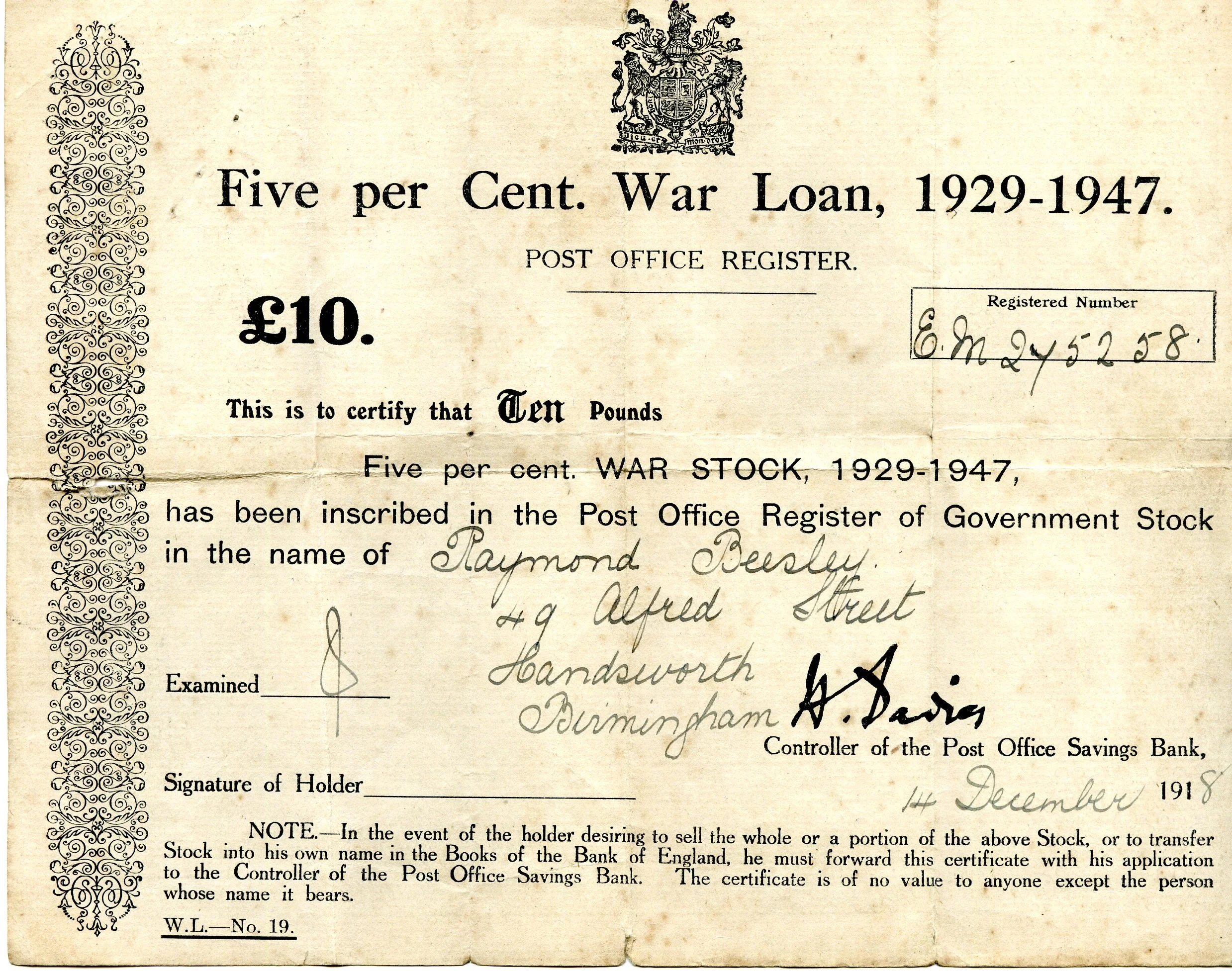

The Return of Bonds

For those of us who work in fixed-income, bonds never went anywhere. But for the general public, they are firmly back on the menu.

The not-so-subtle art of policy making

Since the BoE’s meaty 50bp rate rise in June – following a period of complacency earlier this year – inflation data has relented somewhat. The Monetary Policy Committee opted for a less aggressive 25bp rise at its August meeting, taking rates to 5.25%.

How tech gets smarter

A fascinating story doing the rounds this week focused on an academic assault upon tech’s latest darling as it was reported that ChatGPT was getting “dumber”.

A sticky situation for UK banks

Interest rates have gone up considerably over the past 12 months, especially in the UK. And the headlines are shouting about the impact on borrowers, particularly mortgage holders. Yet, on the other side of the balance sheet, savers don’t seem to be getting a commensurate uplift on their savings rates.

Why the UK must make the Mansion House Reforms a reality

The speech delivered this week by British Chancellor, Jeremy Hunt, to City executives at Mansion House in London got a lot of people thinking about pension reform.

Reflecting on 7 years of Origin

This week we attended the Global Capital Bond Awards dinner, where for the third year in a row, we won two awards, Best Technology Platform for the SSA Primary Bond Market & Best Technology Platform for the FIG Primary Bond Market!

Why London could write crypto’s next chapter

London’s Tech Week is always an opportunity to assess the strengths of the capital’s tech push.

An update on the CMU from the heart of Europe

This week on the blog, Rainer Wagner – who flies the flag for Origin from Frankfurt – gives his take on the state of the EU’s Capital Markets Union project.

Blockchain, Blockchain, Blockchain

I wrote a blog post in 2018 entitled “Blockchain: A Reality Check”, in which I questioned the relevance of this technology within debt capital markets, so I thought it would be fun to revisit 5 years later.

A first for Origin – and the bond market

This week, Volvo Treasury AB successfully completed a dual tranche, €1 billion syndicated benchmark bond issuance via the Origin platform.

CBDCs: Falling short in theory and reality

This week I thought it would be interesting to give a quick comment on the debate that continues around central bank digital currencies (CBDC).

How sterling surprised us all

This week the pound rose to its highest level since April 2022. Stronger than expected gross domestic product, manufacturing and jobs data, a fall in the price of natural gas, and broad weakness in the dollar have all contributed to the sterling comeback story.

Receive content like this directly to your inbox.

Subscribe to our mailing list. We will never share your details.